AZ InfoCollection publishes the latest data in the Statistical Observatory.

Milan, March 21, 2016 – The profile of Italian debtors has changed significantly over the last year. The main findings highlighted in AZ InfoCollection’s latest Statistical Observatory publication are:

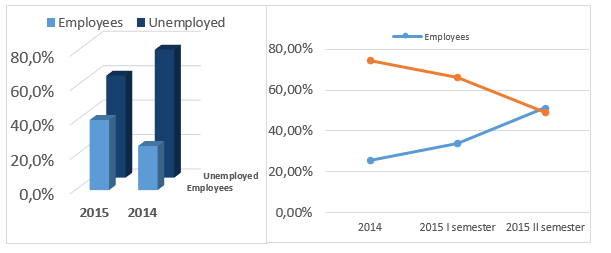

-The level of debtor employment increased from 26.6% in 2014 to 40.7% in 2015;

-The second half of 2015 had the highest increase of occupancy rate, this is possibly related to the Jobs Act approved by the Government in March 2015;

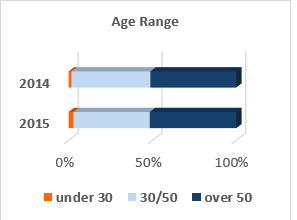

-The age group of employees that saw the most significant growth was the Under-30s (from 1.64% in 2014 to 3.2% in 2015);

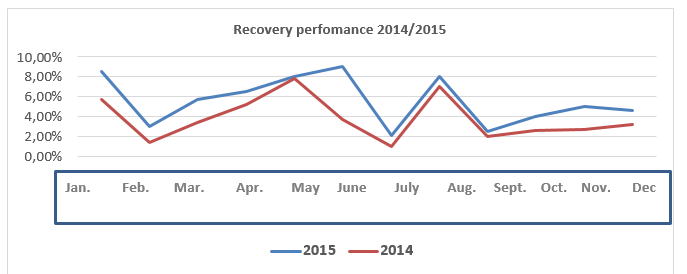

-The employment trends contributed to the better recovery performance recorded in 2015 compared to the previous year; if the phenomenon continues, the credit servicer could play a key role in raising the value of NPL portfolios.

The purpose of the Statistical Observatory published by AZ InfoCollection is to analyze the correlation between the change of debtors profile in 2014/2015 and the improvement of recovery performance recorded over the same period.

The data collected covers the whole cluster of debtors within the relevant timeframe.

The trend highlighted underlines a net increase of the employment rate, with a surge in the second half of 2015 as evidenced by the tables:

In 2015 age group of employees that saw the most significant growth was the Under-30s, as shown in the figure below

The analysis performed detected a significant increase in private sector employment that went from 70% to 81% with a particular concentration in central Italy.

Assuming that a larger number of people employed increases the amount of recovered credit, it is possible to correlate the improved performance observed by AZ InfoCollection (2015 Vs 2014) to the data reported by this study.

According to the latest data published by PWC on defaults (1), the value of NPL transactions planned for 2016 will be about 20 billion euro in the Italian market. We can assume that the effect of the Jobs Act concerning employment will continue to impact positively also in 2016, producing a performance increase in the estimated recovery curves between 7% and 10%;

By applying the performance increase to the estimated value of expected transactions, we can assume it will be possible to see a recovery surplus between 1 and 1.5 billion euro.

Considering this increase in value in the recovery phase, the NPL portfolio purchase price should also see an increase.

AZ InfoCollection, as a full credit servicer, will therefore play a crucial role affecting the purchase price of portfolios and facilitating the matching of demand and supply in the market.

The better the performance of the servicer will be, the better the impact on the mobilization of NPLs in the Italian financial system.

—-

[1] Milano Finanza – 27/01/2016

Statistical Observatory – trend 2014/2015:

https://www.azinfocollection.it/wp-admin/post.php?post=4324&action=edit&lang=en

Simona Gaudiosi

Media & External Relation

Simona.gaudiosi@azinfocollection.it

AZ InfoCollection is a Group focused on Credit and Anti-fraud services. It is also active in the intelligence & security market and inheritance protection working in all of Italy. Clients are major national financial institutions, international funds, utility companies, retail companies and SMEs. www.azinfocollection.it

Info at:

Gruppo AZ InfoCollection S.p.A.

Phone: +39 366259 7197

www.azinfocollection.it