Exactly one year ago, Annamaria Pisano switched from back office executive of debt collection to Head of Insurance within the Antifraud Business Unit in AZ InfoCollection.

An important and decisive change of role, that marked an improvement in both the person and the whole sector itself. Graduated in Law and currently attending a Professional Master’s Programme in Project Management at the Business School of “Il Sole 24 Ore”, Annamaria Pisano is a determined woman with the right skills to be a leader, especially in a sector characterized by the presence of men for the 98%.

“I came in AZ InfoCollection aware that an important work experience was about to begin, but never had I expected a promotion to Manager of a very sensitive area such as the antifraud. I can’t hide a first moment of hesitation. The main concern was whether I could live up to the role I had been offered. I am a very thoughtful person, but also extremely open to changes and new challenges, so I couldn’t but accept this offer.”

A new job, but also a new way of working …

“The back office experience helped me a lot to develop my organizational skills. It was a fundamental training that still today allows me to plan with foresight the different tasks and projects that come up.”

Let’s try to outline what your tasks regarding anti-fraud are.

“We take care of the veracity of claims in every field. We work to uncover false accidents or ruses made to the detriment of insurance policies. My team is composed by 6 internal back office agents, who interface with 50 associates mainly located in the centre-south of Italy, but we manage to cover the entire national territory.

Our work starts from an internal score, set with a check through our software, and then it moves to an analysis of the accident criticality. Following this, the claim is forwarded to the external associate who deals with medical interventions, authorities, etc … After this step, the documentation returns “internally” for a screening by the intelligence. Obviously, here in AZ InfoCollection we are advantaged thanks to the presence of a very strong info providing sector “.

Which are the necessary skills to be part of this sector ?

“Intuition, great interpersonal skills and willingness to work in a team are undoubtedly necessary skills; ours is a constant teamwork, no “piece” can move by itself. I make sure that the machine works properly, but I’m lucky to work with a great team. We are always on the ball as deadlines are critical in this job; moreover, we are able to change our internal processes, adapting them to the demands of insurance companies and this is another big advantage. In fact, today we can record a great percentage of actions turned down and claims for compensation, whereas quality assignments have significantly increased. “

What is the segment you are faced with today, concerning claims?

“The automotive one is no longer the reference market, there’s room also for professional liability, fire and theft insurance claims; besides, speculation on animals has increased too. Given the situation, the team’s versatility has been crucial. We have therefore developed, with no particular difficulty, new internal, professional competences, and now we manage to fulfil even the most complicated tasks.”

Categoria: Press release & News

Get in shape your portfolio with a new e-book of AZ InfoCollection!

The new e-book is a sort of vademecum, a metaphor to reshape a credit portfolio!

Not only the body, but even a credit portfolio can “regain its own form.” We have identified a number of steps that could reflect the different stages of a physical recovery, and at the same time we have been inspired by these to explain how it is possible to revive the fate of a portfolio of non-performing loans.

The aim is to mark a route to be guided within the stack of financial information.

A reflection of our time, a concrete proposal to the resolution of debt collection that today is gripping banks. An e-book in full AZ InfoCollection style that cares about the resolution of that problem through several steps and tips, providing ideas and guidelines based on years of experience and technological innovations.

The work consists of four chapters, each one showing the importance of relying on a “local” partner that knows how to rally round with respect to the complexity of debt collection in Italy.

- Look in the Mirror (overview of the Italian situation and analysis of our target: the international prospects)

- Plan a Roadmap to Health (the importance of a “local” partner within the dynamics of debt collection in

Italy) - Say no to Stress (procedures, analysis and technology to decrease DSO for the originator and increase IRR for the investor)

- Stay one step ahead (Innovations within the field of debt collection)

The e-book can be downloaded for free, filling the form.

[gravityform id=”11″ title=”true” description=”false”]

ANTONIO OREFICE, THE COMPANY CFO

A pure, energetic Neapolitan, always devoted to business growth, Antonio Orefice has held the position of CFO in AZ InfoCollection since five years. Eyes and heart of the property, not only does he have control of the purely administrative side, but also of the whole company staff. His experience in the company began during a hot summer in 2012 when he met the President and the CEO of AZ InfoCollection, and fell in love with the idea of taking part to an ambitious project.

I met Antonino Restino and Carmine Evangelista in July 2012, and when they illustrated the project of AZ InfoCollection to me, I immediately realized there was an interesting work to bring forward. With a great professional experience behind, they were ready to throw their hearts over the bar. They had a new project in mind and wanted to dabble in something they had never dealt with before. As the numbers were growing, the need of building up a new, organic “structure” increased as well. I remember that basically every week Carmine Evangelista moved to Milan to follow the business that was arising in Lombardy; indeed, that was the moment I was hired in the company. I preferred to spend the month of August “studying”, in order to understand how everything worked, and in September my collaboration began.

With his twenty-year experience behind, always holding the position of chief financial officer, Antonio Orefice has found a new natural habitat within AZ InfoCollection.

I worked in a business for 20 years, holding similar tasks overall. During that time the core business was represented by the construction sector, but even in that circumstance I was involved in other types of activities too. Therefore, it wasn’t hard for me to adapt to the company’s versatility in AZ InfoCollection, which branches out its activities following different business.

Strict and easy-going at the same time, Antonio Orefice is seen as a true leader by his team, whom he cares of with painstaking devotion.

I can say that much of my current team has grown up with me, and today I feel happy that they manage to literally embody the concept of team.

But Orefice does not restrict himself to the role of CFO …

It’s more a matter of needs. I’ve tried to broaden my views to general affairs too, and I try to understand the different needs that arise in the company. This is something I do with pleasure, indeed because it’s one of my operative skills.

Over time, AZ InfoCollection has changed again, and now is living a period of great growth.

Towards the end of 2015 there was the act of purchase of the new headquarters; on that occasion I was well aware of the important implications that were arising. At the end of 2016 we completed the renovations here at Naples’ Centro Direzionale, increasing the number of spaces that we had dedicated to work until then. Today we have larger rooms and, given the current projects, we’ve necessarily begun a massive recruitment activity too.

In my opinion AZ InfoCollection is real showpiece within the context of Naples. Year after year we manage to improve balance performances, always getting positive results. We are having a remarkable growth in terms of both turnover and profits, so we look at the future with a healthy and justified optimism.

Daniele Chiusole, from Asset Manager to Head of Collection and Credit Servicing of AZ InfoCollection

Reserved, professional and extremely focused, these are the main features that catch the eye when working side by side with Daniele Chiusole. Born in Trento, and belonging to the ’80s class, Daniele joined AZ InfoCollection in September 2015 as a Performer Asset Manager. To date, he holds the position of Head of Collection and Credit Servicing.

When I arrived here in September my aim, as it then occurred, was to structure the debt collection field, established two years earlier, in a more organic way, in order to become competitive at a national level. Since that day many steps forwards have been done, and now AZ InfoCollection is a very dynamic reality and always projected towards new challenges. Today, considered the financial / banking DNA, we are expanding the sector towards different types of credit such as the Energy one.

During his past career he held the position of Asset Manager in TELKOM S.P.A, another large company within the Credit Management field, where he managed large flows of figures to normalize.

Actually, my first work experience was in Intellservice (2010-2012) where I was involved within the management of commercial credit. In a first instance, I saw this new world as a “foothold”, but over time I began to find it extremely interesting and much more complex than I had thought. This really fascinated me, so I dedicate myself on it. Even on that occasion I ran multiple workgroups. Later, I decided to change type of work, switching from corporate credit to banking and financial credit, and I must say that even there I gained good experience. Then I was introduced to the reality of AZ InfoCollection and I decided to join the project because it was a nice challenge that attracted me a lot. It was the right reality where to make the best of my knowledge.

Reference point in the company, thanks to his expertise, with a keen interest in the world of bad debts (NPL) of which he is an expert analyst, Daniele coordinates workgroups, liaising with clients to define and propose the best strategies. Among other duties, in AZ InfoCollection he is contributing to the development of the Debt Collection sector, holding the responsibility of the whole area, including the different sectors of Phone, Home Collection and Master Legal, working on the implementation of operational strategies, as well as carrying out activities of management, credit analysis and definition.

AZ InfoCollection has got an enormous strength point, given by the symbiosis between the debt collection and the info providing. Being it a reality always on the move, it is aimed at the continuous development of its business dynamics. Inside it has a qualified staff, with people holding a great expertise in the business, and this allows us to have a 360-degree perspective with anything concerning banking / financial collection. A key element to optimize credit management, then, is the use of technology. In fact, our company can rely on management software designed to integrate operations with strategic application, this being very helpful in the integration between collection activities and info providing, thus representing a competitive advantage that allows us to distinguish ourselves from our competitors.

Asking him for an opinion on the NPL market in Italy, he replied:

This is a golden period in this field. Of course, those who want to join the market must consider that credit values are now fairly saturated, so profit margins are decreasing, especially regarding investments on large deal where the competition is very fierce. To date, in my opinion, the most interesting part is that concerning small or medium-sized portfolio. Beyond all, it is necessary to hold an extreme understanding of the market in this field, as it’s very easy to make a misstep; therefore a detailed analysis of the situation is always needed. Not by chance, UTPs are lately taken into account as a new business segment and our latest Observatory shows that this could be a very interesting category to consider for the future.

AZ InfoCollection has a new Head of Legal Collection: Ilaria Della Corte

One of the greatest resources of a company is being able to remain on the move at all times. Inevitable, growth implies a continuous flow of ideas, projects, initiatives, and purchasing resources. AZ InfoCollection is scaling the different stages of the business, one after the other, establishing itself among the key players of the moment on the financial landscape. The all-round servicer vocation has led the company to hire a new resource at the start of this new year for the position of Head of Legal Collection within our large corporate team. We present Ilaria Della Corte!

A top graduate of the Federico II University in Naples, and with a business background worthy of the utmost respect, her résumé includes experience in forensics followed by a good deal of professional expertise in the field of credit collection. After an important period in Milan at the BNP Paribas Group and GERI HDP, following a career path that has led her to experience both corporate and individual fields, her talent was intercepted by AZ InfoCollection, bringing her back to her homeland (Naples) and embrace the new company project.

“AZ InfoCollection is a wager that I am happy to accept. It is a company that has gone unnoticed in the field of debt collection and which for me represents a “leap in quality”, at the just right time in my career. I am convinced that the NPL sector is to the place to work over the coming years; the situation is obvious to everyone and I think the conditions are in place to let me do a great job. “

Determined, motivated and outspoken, Ilaria will occupy a prominent role within the company, focusing on the legal sector and work hard to collect these portfolios with a “trump card”.

Ilaria continues: “I will of course be bringing all my business know-how to the company, with the addition of my strong interest and passion for my field. We also should not forget that compared to other servicers, AZ InfoCollection has an edge regarding credit management, an internal info providing department that allows us to work faster and also to provide excellent prices. Legal recovery is complicated because it unfortunately takes a very long time and requires expensive resources. Here in AZ InfoCollection I have the luxury of working hand in hand with my colleagues in the information department, “exploiting” a vital sector for the legal area to achieve excellent quality performance with the advantage of working with knowledge of the facts and consequently with better timeframe and cost effectiveness. “

The choice of Head of Legal collection fell to Ilaria after careful analysis of her previous work experience that led her to take a career path that is well suited to the role she will be filling. Her professional background in fact includes the management and coordination of a dense network of external lawyers. She also has experience both in the field of utilities and in reference to the sale of bankruptcy proceedings.

To the challenging question of how important her position will be within the company, Ilaria replied: “I come from a business logic where even small-tickets were recovered with injunctions; we acted on the whole because in Italy there is a conviction that a debt will be forgotten sooner or later, and abandoned. Unfortunately, I think the law, too tends to lean on the side of the debtor and red tape does not help. Of course I am for the middle way: I consider that it is always better to settle out of court, but when you are faced with very large portfolios and complicated situations, I believe we must act now, identifying the problem and using the resources and professionalism available to bring home the result. “

At the end of our conversation we asked her a motto, a phrase in which she sees herself.

“I like the phrase by Seneca: “There is no favorable wind for the sailor who does not know where to go,” I always identify my goals before moving a step, but once I do, I aim straight for them.”

AZ delivers C.I.R.O.

Naples, July 14, 2016 – Credit Information Report Online, C.I.R.O. is a new online platform developed by AZ InfoCollection in order to provide its customers with a detailed description of their debtors.

Info-providing activities have always been the strongpoint of the Napolitan company, a business which now has been upgraded in look, feel and skills. With the new portal, the customer will be able to obtain segmented and personalized information on their debtors in a very short time.

C.I.R.O. will be the digital driver that will lead users in search of new cognitive experiences.

The rich database will allow detailed and thorough analyseis and make the most of a recovery strategy thanks also to the deep historical data.

C.I.R.O. doesn’t just return data, it allows real interactions with customers, building a path tailored to every need.

With over a million fiscal codes you can handle either one single debtor or hundreds of thousands of records quickly and easily from any computer with online access. Thanks to a dedicated area, customers are able to follow the working processes, step by step.

C.I.R.O. has also been designed with the input of the AZ InfoCollection President, Antonino Restino, one of the first graduates in computer science, when he still worked in assembly with punch cards.

“I am very proud of the result, but even more for the vision that guides us as leaders in a strategic field” – states the President Restino – “C.I.R.O. will be a jump forward in terms of info-providing, facilitating the service of credit operations”.

Currently the platform is in phase one; soon the platform will enter phase two in which customers will be able to synchronize their debtor database and ensure a true exchange of intelligent information.

The platform was presented July 6, 2016 at an exclusive event, organized by AZ InfoCollection, in the charming location of Villa Crespi.

C.I.R.O.: Smart data for a Smart system.

The AZ InfoCollection real estate revolution has begun!

AZ InfoCollection continues on its quest towards the achievement of its primary goal: to operate as a full credit servicer across all asset classes.

The Group is pleased to present a new line of products fully dedicated to the identification and rapid appraisal of real estate assets of debtors in secured NPL positions.

AZ InfoCollection business path has successfully led the Group to be considered an example of operational excellence in the field of information on single debtors. 40 years of experience have allowed the Group to build specific know-how and a massive internal database, which stands out as unique in the market.

The Group is now able to add a further level of detail on debtors: in addition to economic and financial information, we provide our customers with an overview of the real estate property of debtors with a massive or specific focus according to the customer’s required needs.

AZ InfoCollection has created two innovative services that will allow the maximum performance of secured portfolios!

Asset Hound:

the sharpest nose on the real estate trail! This product identifies assets, verifies liens and encumberances, and determines the mortgageable value of the property

Asset View:

this product provides a precise picture of all debtors’ real estate assets and includes the value of the unencumbered properties

AZ InfoCollection guarantees highly customized solutions supported by a team of professionals entirely dedicated to the real estate sector.

Let’s meet Antonio Vitolo

1)You are working for AZ since long time, tell us about your experience in the Group.

I’ve been working within the Group for about 10 years. At the time I joined AZ the team was composed by only 15 people, excluded the external collaborators. The team welcomed me in a very friendly way and made me feel like a member of the group.

The atmosphere that I was feeling in AZ (and is the same today) was really good and the relationship with colleagues was great. In fact, this team has been always ready to address any issues and achieve year after year more ambitious goals.

I started my experience in AZ within the insurance department by coordinating the activities of the staff within the Campania region. Then, after about one year, I started a training course in the intelligence field, taking care of the first private customers and then companies.

Thanks to my enthusiasm, to the support of my managers and cooperation of my colleagues, I was able to become responsible and coordinator of both the Intelligence (Private and Business investigations) department and the Anti-Fraud department.

From 2009 we had a significant increase of workload thanks to acquisitions of new clients.

Finally in 2015, following a reorganization, I was entrusted with the responsibility of the infoproviding unit, historic area and the main area of the AZ Group, with the aim of making it growing more.

I am lucky since I’ve been able, within a few years, to deal with so many areas and I am grateful to those who believed in me.

2) What does your department do in details?

The main objective of the infoproviding team is to track debtors. The team analyze the debtor earnings consistency, equity and financial positions in order to allow the creditor (our client) to recover the amount owed.

3) What are the basic qualities that should have your team?

The main quality I look for my staff is the accuracy in the search for details and information. Our employees analyze a huge variety of debtor cases that goes from loan debt, mortgage debt, debts to utilities companies to debts to family.

Although our internal processes are well-defined thanks to our huge know how, the team must be able to study deeply each case, trying to get as much as useful information to our customers.

4 ) How important is the processes’ digitalization in your department?

The digitalization is essential, without any doubt.

We collect a huge number of information on each debtor (individual and / or company) so it is absolutely necessary to use a data base which allows us to :

• Store data correctly

• Consult data in case of recurrences

• Reset mistakes associated with manual tasks

• Minimize customer response times

5 ) What are the next digital projects planned?

The goal of AZ is to try to increase the automation of processes in order to make the activities as fast and safe as possible.

Our IT department is always looking for innovative software that can facilitate the daily activities of the team. AZ has designed a revolutionary system, C.I.R.O. , which will enable our customers to interface with the internal management system in a totally digital wat to easily send orders , refer to the activities and receive works in progress .

AZ InfoCollection publishes the latest data in the Statistical Observatory.

Milan, March 21, 2016 – The profile of Italian debtors has changed significantly over the last year. The main findings highlighted in AZ InfoCollection’s latest Statistical Observatory publication are:

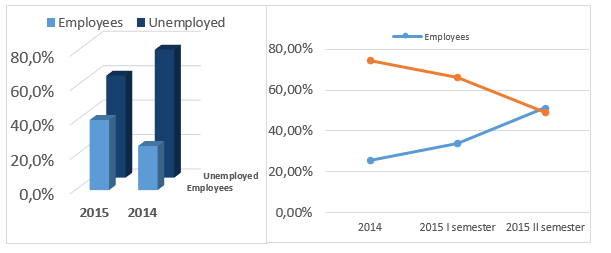

-The level of debtor employment increased from 26.6% in 2014 to 40.7% in 2015;

-The second half of 2015 had the highest increase of occupancy rate, this is possibly related to the Jobs Act approved by the Government in March 2015;

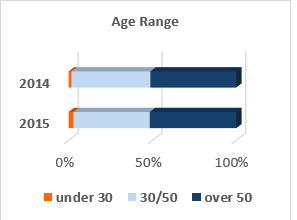

-The age group of employees that saw the most significant growth was the Under-30s (from 1.64% in 2014 to 3.2% in 2015);

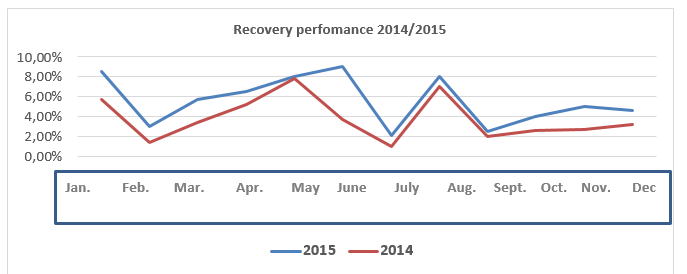

-The employment trends contributed to the better recovery performance recorded in 2015 compared to the previous year; if the phenomenon continues, the credit servicer could play a key role in raising the value of NPL portfolios.

The purpose of the Statistical Observatory published by AZ InfoCollection is to analyze the correlation between the change of debtors profile in 2014/2015 and the improvement of recovery performance recorded over the same period.

The data collected covers the whole cluster of debtors within the relevant timeframe.

The trend highlighted underlines a net increase of the employment rate, with a surge in the second half of 2015 as evidenced by the tables:

In 2015 age group of employees that saw the most significant growth was the Under-30s, as shown in the figure below

The analysis performed detected a significant increase in private sector employment that went from 70% to 81% with a particular concentration in central Italy.

Assuming that a larger number of people employed increases the amount of recovered credit, it is possible to correlate the improved performance observed by AZ InfoCollection (2015 Vs 2014) to the data reported by this study.

According to the latest data published by PWC on defaults (1), the value of NPL transactions planned for 2016 will be about 20 billion euro in the Italian market. We can assume that the effect of the Jobs Act concerning employment will continue to impact positively also in 2016, producing a performance increase in the estimated recovery curves between 7% and 10%;

By applying the performance increase to the estimated value of expected transactions, we can assume it will be possible to see a recovery surplus between 1 and 1.5 billion euro.

Considering this increase in value in the recovery phase, the NPL portfolio purchase price should also see an increase.

AZ InfoCollection, as a full credit servicer, will therefore play a crucial role affecting the purchase price of portfolios and facilitating the matching of demand and supply in the market.

The better the performance of the servicer will be, the better the impact on the mobilization of NPLs in the Italian financial system.

—-

[1] Milano Finanza – 27/01/2016

Statistical Observatory – trend 2014/2015:

https://www.azinfocollection.it/wp-admin/post.php?post=4324&action=edit&lang=en

Simona Gaudiosi

Media & External Relation

Simona.gaudiosi@azinfocollection.it

AZ InfoCollection is a Group focused on Credit and Anti-fraud services. It is also active in the intelligence & security market and inheritance protection working in all of Italy. Clients are major national financial institutions, international funds, utility companies, retail companies and SMEs. www.azinfocollection.it

Info at:

Gruppo AZ InfoCollection S.p.A.

Phone: +39 366259 7197

www.azinfocollection.it

AZ InfoCollection is attending the 15th edition of the STAR Conference in Borsa italiana

Milan, 14 March 2015 – AZ InfoCollection S.p.A., as member of the ELITE Group of the Italian Stock Exchange, is attending the 15th edition of the STAR Conference taking place at Palazzo Mezzanotte in Milan on March 15th and 16th 2016.

The meeting is dedicated to the companies listed on the STAR Segment and to the whole financial community.

During the conference, organized by Borsa Italiana, analysts and Italian and international investors will have the chance to analyze the results and future perspectives of those SMEs representing the excellence of the Italian companies.

The STAR Conference represents a key milestone for the companies’ member of the ELITE programme, a moment of training and visibility in contact with the financial community.

Carmine Evangelista, AZ InfoCollection CEO, will present the Group to the investors on March 15th at 3.05 pm in the “SALA BLU 60” room.

The presentation’s objective is to give an overview of the Group’s business and reference markets, presenting the key financial results and the strategy for growth.

Antonino Restino, Chairman of the Group, Carmine Evangelista, Group CEO and Simona Gaudiosi, media and external relations, are attending the conference.

Conference programme:

http://www.borsaitaliana.it/starconference2016milan/presentazioneplenarie/publicpresentations.htm

—————————————————————————————————————————————-

Simona Gaudiosi

Media & external relations

Simona.gaudiosi@azinfocollection.it

AZ InfoCollection S.p.A. It is and independent full credit servicer, operating in the management of NPL portfolio with expertise in various asset classes (secured/unsecured – individual, corporate, SME’s) coordinating collection channels and maximizing infoproviding activities. Its main clients are major Italian financial institutions, international funds, utilities and insurance company. AZ InfoCollection is also active in the anti-fraud services, intelligence, security and heritage protection markets. www.azinfocollection.it

Info at AZ InfoCollection S.p.A.

Phone: +39 3662597197 www.azinfocollection.it

comunicazione@azinfocollection.it | stampa@azinfocollection.it